[ad_1]

Daniel Balakov/E+ via Getty Images

Thesis

The Cushing MLP & Infrastructure Total Return Fund (NYSE:SRV) is a closed end fund focused on MLP equities. Per the fund’s literature:

The Fund is a non-diversified, closed-end management investment company with an investment objective of seeking a high after-tax total return from a combination of capital appreciation and current income. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in master limited partnership investments.

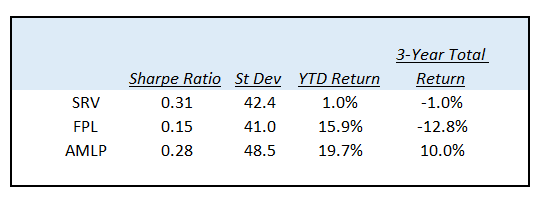

The fund is fairly small with only $111mm of assets and has posted very poor returns. SRV is flat on a total return basis in 2022, when the entire Energy sector is up substantially and other CEFs and ETFs in the MLP space have recorded double digit returns. When looking on a 3- and 10-year time frame the CEF has posted flat or deeply negative total returns, and that is before inflation is taken into account. The fund just does not deliver on a standalone basis or when compared to its peers:

Analytics (Author)

We can see SRV, which employs a 27% leverage ratio, is flat both on a year to date and 3-year time frame total return basis. The vehicle basically does nothing with a very high volatility. Its peers, which are as volatile as SRV, at least deliver better returns. The fund has a massive -23% discount to NAV, which in our minds is justified. There is nothing here to incentivize an investor to jump in. In our humble opinion the fund manager would do well to liquidate and realize the 23% immediate gain and distribute it to shareholders.

SRV is a CEF with an MLP equity composition. The fund is very volatile, employs a high leverage ratio of 27% and has achieved flat or negative results in the past. Although we feel the MLP sector is on the mend from both a balance sheet and capital allocation perspectives we do not think SRV is the appropriate vehicle to capture alpha in this sector. The vehicle has a small dividend yield of 5.8% and fails to impress from any angle. A retail investor looking into the MLP space would do well to look elsewhere.

What are MLPs

SRV is a CEF that provides investors access to a lesser known asset class, namely Master Limited Partnerships from the Oil & Gas sector. MLP is a fancy way of describing a form of incorporation for a company that generally runs pipeline and processing infrastructure for the Oil & Gas sector. In a nutshell, a classic MLP is a company which owns transportation (pipelines) and storage facilities for oil and gas. Since this business has traditionally been very stable (irrespective of oil prices, the actual liquid has to be transported from the extraction site to a port or storage facility) many large corporates chose to spin off their transportation and storage arms into free standing companies with long-term standing transportation contracts. The MLP format provided tax advantages for both the respective companies as well as investors.

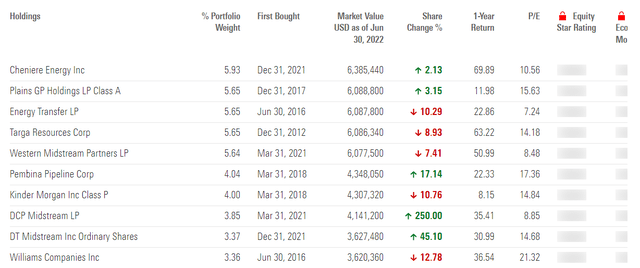

Holdings

The fund’s top holdings are well known MLP names:

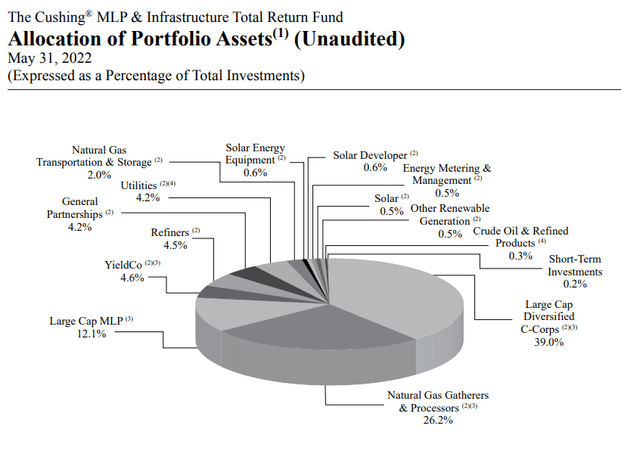

The industry parsing for the fund is as follows:

Sectoral Allocation (Semi-Annual Report)

We can see that the fund is overweight Large Cap Diversified C-Corps and Natural Gas Gatherers & Processors.

Performance

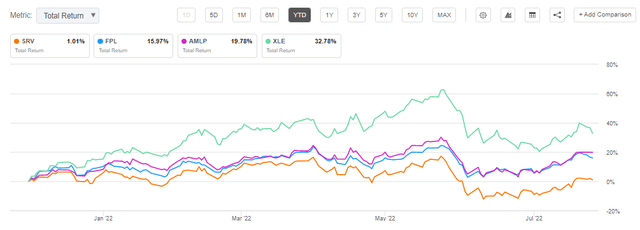

The fund is flat on a year to date basis:

YTD Total Return (Seeking Alpha)

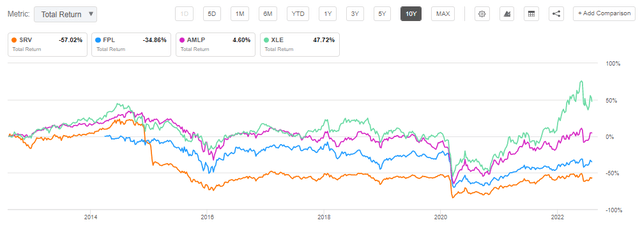

When compared to other MLP CEFs such as the First Trust New Opportunities MLP & Energy Fund (FPL) or the most popular ETF in the space (AMLP), SRV underperformed in 2022.

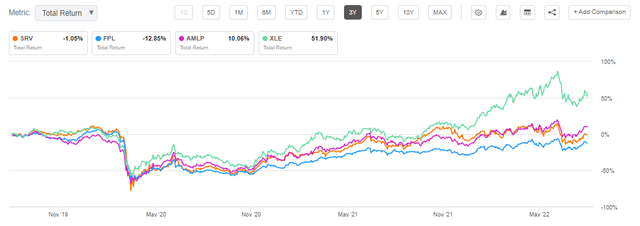

The metrics are similar when utilizing a 3-year lookback period:

3Y Total Returns (seeking alpha)

We can see that SRV is again fairly flat from a total return perspective versus the other considered investment instruments. Ultimately an investor buys a security for a return and SRV has not delivered. On a 10-year basis the fund is deeply negative on a total return basis:

We do not like asset classes which expose deep negative performance on a long term basis because they speak to systemic issues in the respective product line. For the MLP asset class the story was one of overinvestment and excessive leverage which resulted in a poor performance. When adding leverage to a poor performer you get a magnified poor performer.

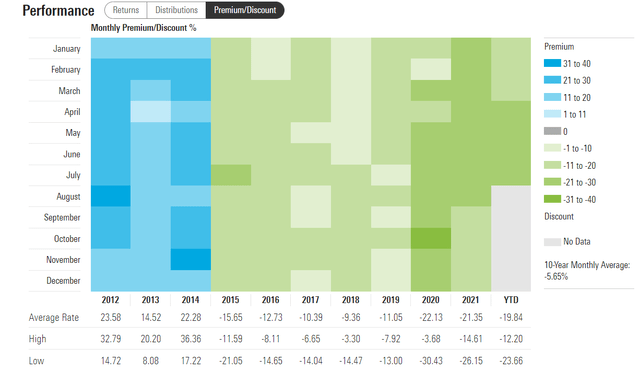

Premium / Discount to NAV

The fund has always traded at a discount to net asset value in the past seven years:

It is shocking to see how this fund traded at a -30% discount to net asset value during the depths of the Covid crisis!

Conclusion

SRV is a closed end fund focused on MLP equities. The CEF is fairly small with only a $111mm AUM. The vehicle has a very large discount to NAV of -23% due to its very poor performance. The fund is flat in 2022 when Energy has outperformed and its peers have posted double digit total returns. On longer time horizons the fund is either flat or negative from a total return perspective. We feel SRV might be a story where the shareholders would be more advantaged if the manager just liquidated the collateral and realized the discount to NAV, although we feel the probability for this to occur is very small. The vehicle has a small dividend yield of 5.8% and fails to impress from any angle. A retail investor looking into the MLP space would do well to look elsewhere.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.