[ad_1]

vernonwiley

Thesis

Cohen & Steers Real Estate Opportunities and Income Fund (NYSE:RLTY) is a new closed end fund from Cohen & Steers. The vehicle was launched in February 2022 and focuses on REIT equities. The fund has current income as an objective and employs 33% leverage on a portfolio of REIT common and preferred equities to achieve that goal. What is interesting about this fund is the fact that it ramped up very quickly after it IPO-ed and was able to “capture” fully the market sell-off witnessed so far in 2022. The fund is down -15% year to date, slightly outperforming the S&P 500.

If an investor looks at historic CEF performances, they will notice a funny commonality – they all tend to lose money in the first 1-2 years. A CEF usually prices at $20/share but usually ends up lower. Not all CEFs are created equal, of course, but since launch the management team has a certain pressure to allocate capital, irrespective of timing, which might not be optimal for the ultimate investor. Reviewing very well established managers such as PIMCO or BlackRock (BLK), especially on the fixed income side, gives a good glimpse into this incipient vehicle behavior. Again, our view here is that the manager experiences significant pressure to put cash to work in order to justify the charged fees, and in the process of doing so it invests at sub-optimal periods. We have witnessed the same behavior here – if the RLTY management team would have staggered their asset purchases into the year, they would have generated a much better performance and would have entered securities at fantastic prices during the May/June sell-off.

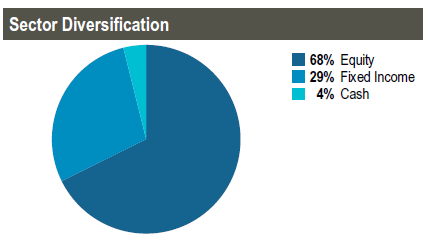

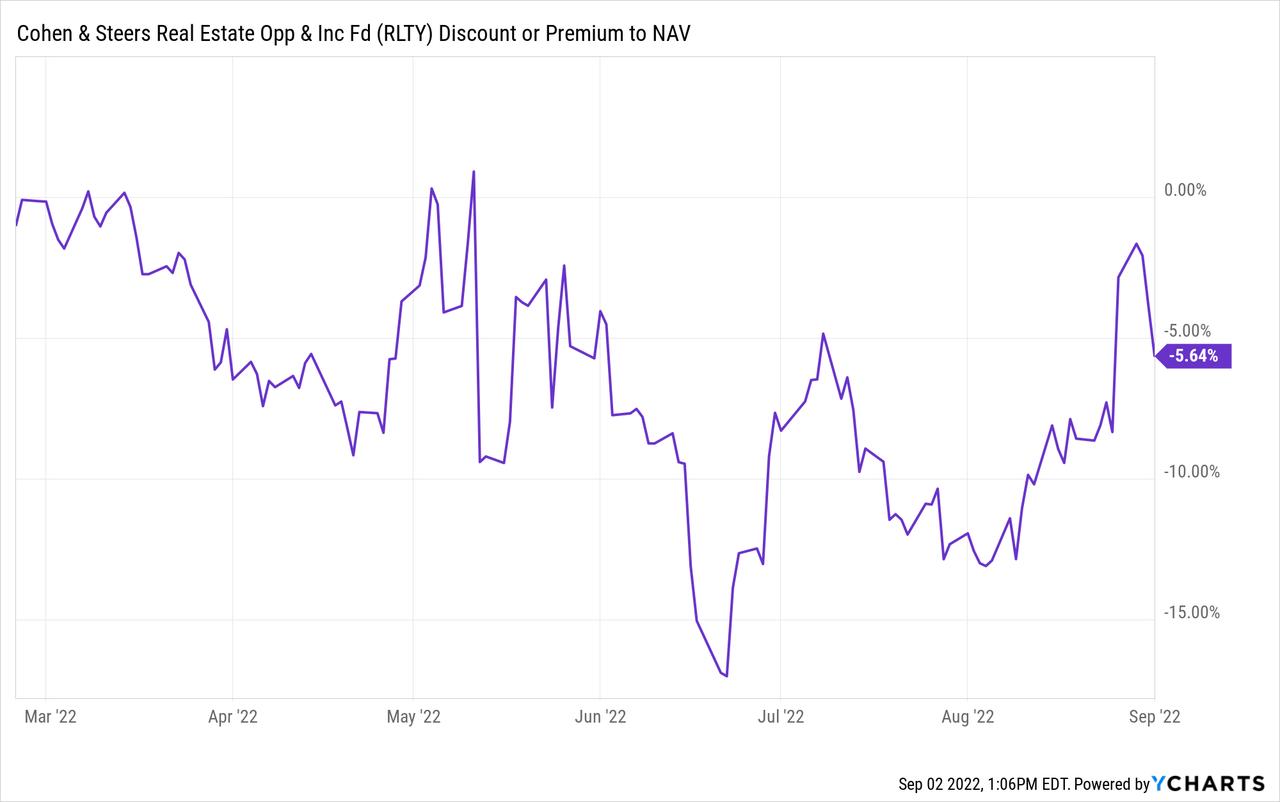

The fund focuses on REIT equities which account for over 68% of the portfolio, with the other slice overweight financials preferred securities. We do not have a year’s worth of data to run analytics regarding performance, risk/reward metrics and volatility but Cohen & Steers is a manager with a great track record. Because it is a new fund the CEF is trading at a discount which currently comes in at -5.64%. Most Cohen funds are currently trading at a premium to net asset value, so we expect RLTY to do so as well in 2023 after the market has digested a bit of track record with the fund. We are in a wait and see mode with this fund – we think the vehicle has a bright future but near term there are challenges. We see the fund losing more value as the next leg of this bear market develops but RLTY is to be kept on the radar screen.

Holdings

The fund is overweight REIT equities:

Sector Allocation (Fund Fact Sheet)

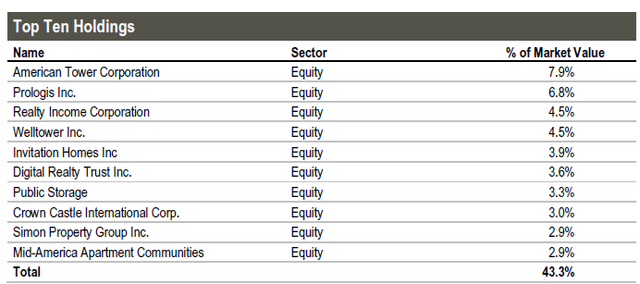

We can see that two-thirds of the fund is invested in common equity issued by REIT structures. The top holdings in the fund are reflective of that allocation:

Top Holdings (Fund Fact Sheet)

We can see from the top ten holdings that the fund is fairly concentrated, with a very large position in American Tower Corporation (AMT). In fact, the top ten holdings account for almost 50% of the holdings. In our book this is a very concentrated CEF, especially on the equity side.

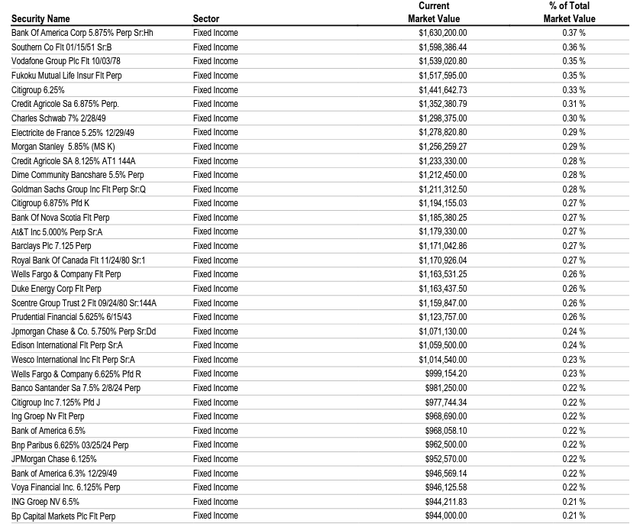

In terms of the bucket labeled as “Fixed Income”, the fund mainly invests in financials’ preferred equities:

Granular Holdings (Fund Website)

We can see that the exposures on the preferred securities are much more granular versus the equity side.

Performance

The fund is new, having IPO-ed only in February 2022, but it has already posted a negative performance:

YTD Performance (Seeking Alpha)

Despite the YTD figures the fund has managed to outperform the Vanguard Real Estate Index Fund ETF (VNQ) and the S&P 500.

Premium/Discount to NAV

The fund has “leaped” to a discount to NAV out of the gates:

This always happens with new funds since the portfolio is unknown and the trading style of the management team is also yet to be established. It is interesting to note the fund experienced a massive discount to NAV during the June market sell-off.

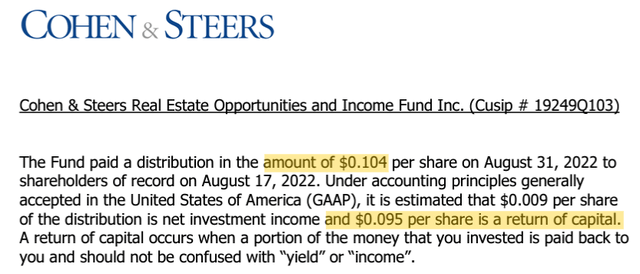

Distributions

Given the negative performance year to date and since inception in February, the fund is mostly disbursing ROC:

We feel this is going to change in 2023, but 2022 is going to be a tough going.

Conclusion

RLTY is a new CEF from Cohen & Steers. The vehicle IPO-ed in February and was quick to ramp up its portfolio when it should not have done so. Instead of being able to take advantage of great opportunities following the June market sell-off RLTY experienced a NAV decrease. Because it focuses mostly on equities, the fund is currently using a lot of ROC to make up the dividend yield. The vehicle is also trading at a discount to NAV, which is unusual for Cohen & Steers funds. We feel the rest of 2022 is going to be difficult for RLTY with a brighter 2023 ahead.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.