[ad_1]

NicoElNino

The iShares MSCI USA Momentum Factor ETF (BATS:MTUM) is an ETF that is designed to respond to the momentum factor, which just means that the ETF is a proxy of investing in a non specific factor of market momentum. In that respect, stay away as we don’t think market levels are tenable in the short-to-medium term. However, the stocks inside look solid. We’re surprised this thing trades like it does. Nonetheless, we trust the design and therefore stay away.

MTUM Breakdown

Let’s discuss some of the salient points about this ETF.

Sector Breakdown (iShares.com)

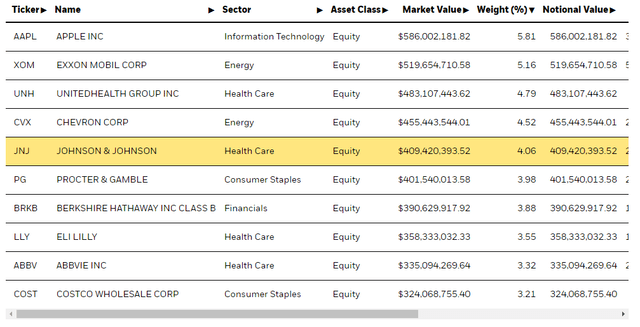

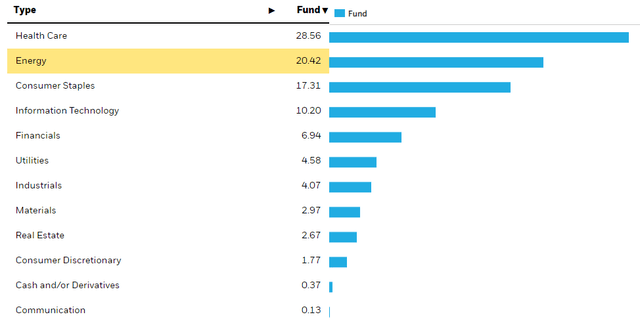

On a sector basis we look at the following chart. Most of the portfolio is in healthcare. But the exposures are in really big pharma. While that comes with its own concerns around recent tax the rich regulation, these should be more stable companies. Some of the pharma allocations have a decent amount of COVID-19 vaccine exposure like Pfizer (PFE) and even Johnson & Johnson (JNJ), but most of the companies are cash generative and good value. Indeed, the overall portfolio only has a 20x PE. It’s not that high.

The more volatile stuff is in the energy allocations where they have integrated E&P exposures. These will be more levered to the macro state. However, even there, we are quite surprised because they have outperformed the broadly declining tech-focused markets. It is odd that they’d drive momentum. In fact, the ETF’s low exposure to IT is perplexing in that regard where tech stocks weight heavily on US indices. However, the performance of the ETF has been tracking what we’d consider momentum pretty well, with YTD declines at almost 20%, and general chart movements consistent with that of the general market. Another strange thing is that the beta is almost exactly 1, and just arrives at effective market risk but solving the problem without having a large technology weight.

Finally, we don’t consider Apple (AAPL), the largest weighting in the ETF, to be such a quintessential momentum stock. It was very resilient despite broad based losses in consumer confidence. While a very large company that carries weight on the indices, it is a very safe business from a fundamental point of view. We’d consider it countercyclical, not direction levered like a momentum stock would be.

Conclusions

To the extent that it actually works as a momentum ETF, we’d stay away. There is a bifurcation between consumer and corporate confidence, and ultimately the consumer is who matters. Unemployment could rise even without the invitation of more rate hikes from the Fed. MTUM could decline meaningfully if the Fed has to keep clubbing the economy to get blooming inflation under control.

However, if you take it for what it is, it’s largely a safe old-guard ETF of US industry. Big pharma has its concerns right now as the Democrats pass legislation to regulate blockbusters more heavily for senior markets. But energy features heavily and has been more connected to geopolitics than market direction, with the factors boosting commodities, especially crude, actually being in the opposite direction to the markets. The 2% yield isn’t bad, and as said a 20x PE is pretty reasonable considering the juggernauts inside this thing. Costs are low too 0.15%. The mandate is momentum though, and longer-term you want to expect that that’s how the portfolio will be built, in which case MTUM is not interesting. But a snapshot at its holdings reveals a relatively benign set of exposures to weather an oncoming recession with, in stark contrast to the portfolio’s stated purpose.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.