[ad_1]

Just to make sure we’re clear on terms, median price means that price at which half the transactions are higher and half the transactions are lower. Put a different way, this means that 1 out of every 2 homes currently available for sale in San Francisco is priced at $1.6 million or higher.

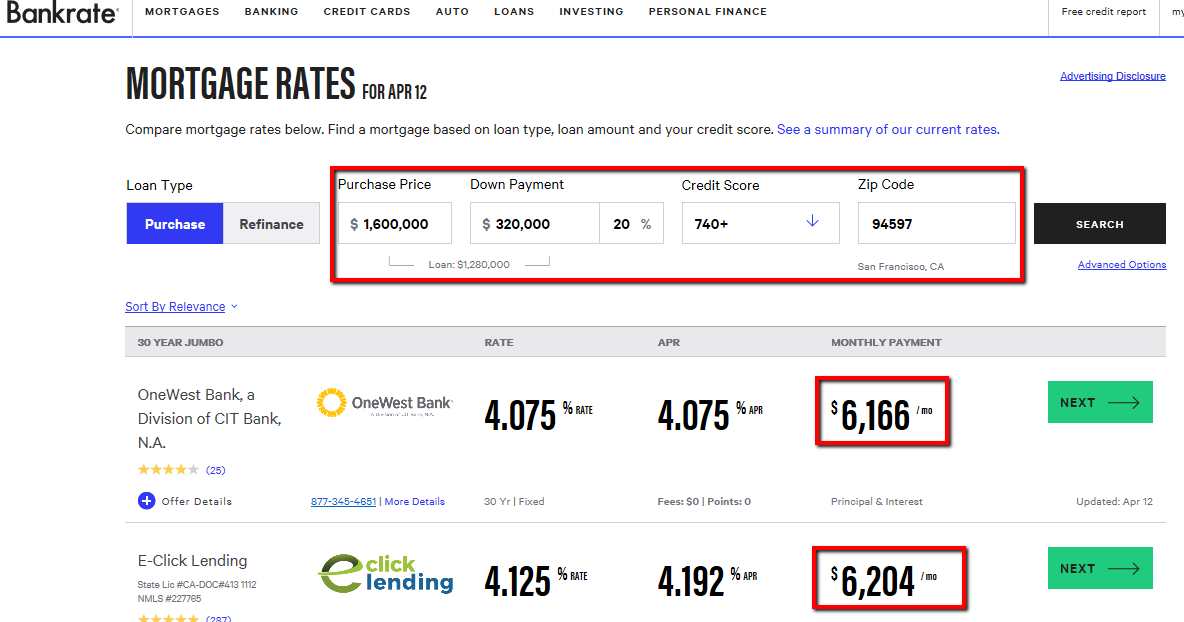

I got curious as to what that implies about affordability. What does it take, in the current mortgage rate environment, to purchase such a home?

Here’s the “standard” answer, from bankrate.com.

As it turns out, at least from the terms available on this website, one must be able to put down 20% to qualify for the 30-year jumbo loan needed to buy such a home. So, you have to be able to come up with $320,000 just to play. Assuming you can pony up that sort of cash, you get the privilege of tying yourself to a monthly mortgage payment of roughly $6,200 for the next 30 years.

To that, add your property taxes, which will likely run you somewhere between $16,000-20,000 per year, and basic homeowner’s insurance for somewhere in the neighborhood (no pun intended) of $2,000 per year. Added together, that’s conservatively another $1,500 per month, giving you a total monthly bill of about $7,700.

What does that all imply? Well, at ratios between 33% – 40% of total income, you would need an annual income of somewhere between $231,000 and $277,000 to satisfy your lender.

So there you have it. Want to live in a median-priced San Francisco home? You’ll need to bring an annual income in the $250,000 range and about $320,000 in cold, hard cash to the party.

Depressed? No worries, there is some good news. Here’s Bloomberg, to close the article.

One silver lining for people out shopping now: The gain in condo prices has moderated as new units come on to the market. The median condo price increased by a relatively modest 4.6 percent from a year earlier, to $1.18 million.

There, that’s better.

[ad_2]

Image and article originally from etfmonkey.blogspot.com. Read the original article here.