[ad_1]

Pgiam/iStock via Getty Images

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2x Shares ETF (NYSEARCA:DRIP), (the “Fund”) seeks daily investment results, before fees and expenses, of 200% of the inverse (or opposite) of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index (“the Index”). There is no guarantee the DRIP exchange-traded fund (“ETF”) will meet its stated investment objectives, and the return will almost certainly vary from its objective if the holding period is less than, or more than, one day.

On June 16, I published an article on Seeking Alpha entitled, DRIP: A Very High Risk Double Oil Short. I concluded that holding the ETF long-term would have been a disaster, but it can be useful short-term, such as Oct-Dec 2018, Jan-April 2020, and an opportunity may present itself to use DRIP at some point in the near future. In this article, I suggest that that timing may be soon, since oil futures contracts are far overpriced.

The largest holdings of the Fund as of the end of July were as follows:

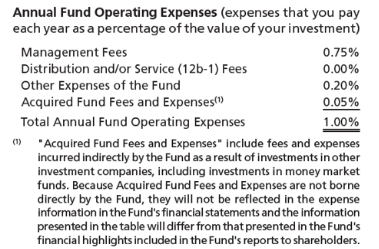

Expenses consist of a management fee of 0.75 % and other expenses as follows:

Direxion

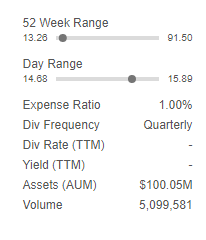

Assets Under Management are about $100 million, up about $40 million since my June article.

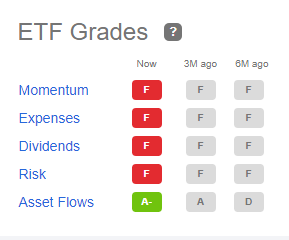

Seeking Alpha

Seeking Alpha has graded DRIP’s Expense Ratio and “F.”

Seeking Alpha

Performance

As indicated above, the long-term performance of DRIP has been awful. It has lost nearly all of its value.

But in the last 5 trading days, it has gained nearly 10%. And there is potential for a large gain in the next few months, as discussed further below.

Crude Oil Futures Outlook

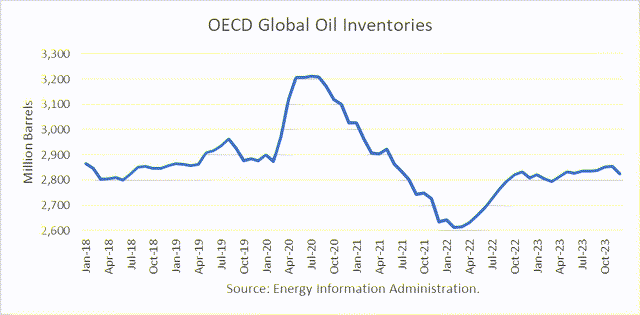

The Energy Information Administration released its Short-Term Energy Outlook (“STEO”) for August, and it shows that OECD oil inventories likely peaked at 3.212 billion in July 2020. In July 2022, it estimated stocks rose by 40 million barrels to end at 2.728 billion, 108 million barrels lower than a year ago.

For 2022, OECD inventories are now projected to build by 173 million barrels to 2.810 billion. For 2023, it forecasts that stocks will build by another 17 million barrels to end the year at 2.826 billion.

EIA

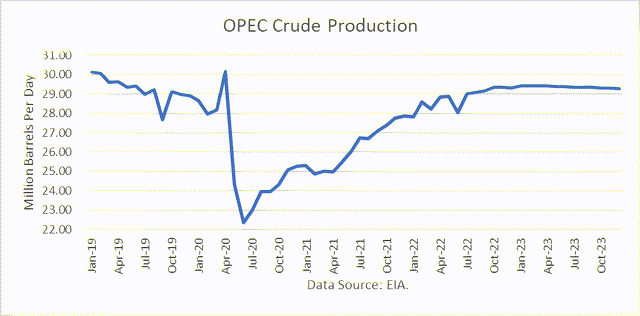

EIA’s inventory forecast is based on OPEC production levels in the graph below. No mention of the Iran nuclear deal and its potential effects on world oil supply was made in the EIA STEO report, and it does not appear that the projections factor in an increase in Iranian oil.

If and when the Iran nuclear deal is concluded, there could be an immediate release of stored oil from Iran on the market. It has been recently reported that Iran may have about 93 million barrels in offshore storage they could sell when the deal is finalized and before they ramp up their production by about 1 to 1.3 million barrels per day.

The Saudi oil minister had said maybe OPEC will cut back its production if Iran comes back into the market. But such a move would be highly criticized by their defender – the U.S. The Russian news agency, Tass, reported that OPEC+ members are not considering a reduction to their output at this time.

Oil Price Implications

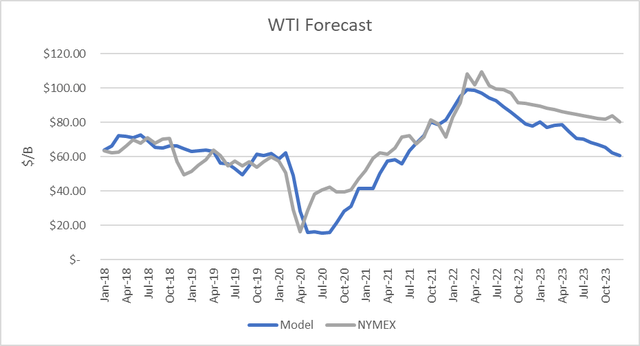

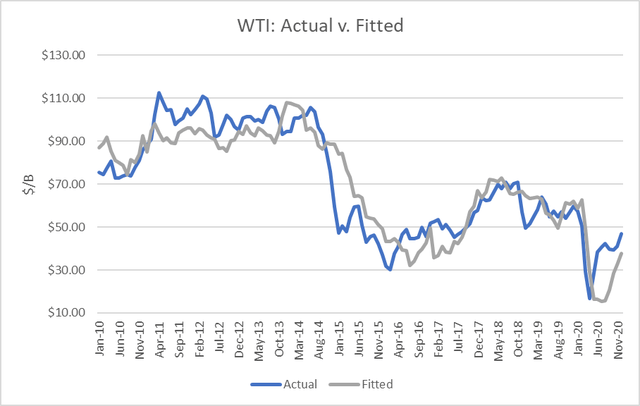

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2020. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 82 percent.

BRS, NYMEX

I used the model to assess WTI oil prices for the EIA forecast period through 2022 and 2023 and compared the regression equation forecast to actual NYMEX futures prices as of August 30th and the EIA’s STEO price forecast in August. The result is that oil futures prices and EIA’s assessments are presently overpriced through December 2023, as depicted below.

Conclusions

DRIP is a leverage financial product focused on the oil and gas sector. It is a very high-risk product that should only be held by sophisticated investors, and then only for limited time periods. Under those conditions, it provides an opportunity for outsized returns. And so it is worth considering DRIP during such periods.

Looking forward, such an opportunity may present itself soon if and when the Iran nuclear deal is concluded. Iran may sell its oil in storage while prices are still relatively high, and it will certainly attempt to return its production to previous levels of about 3.8 million barrels per day, up from about 2.5 recently estimated.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.