[ad_1]

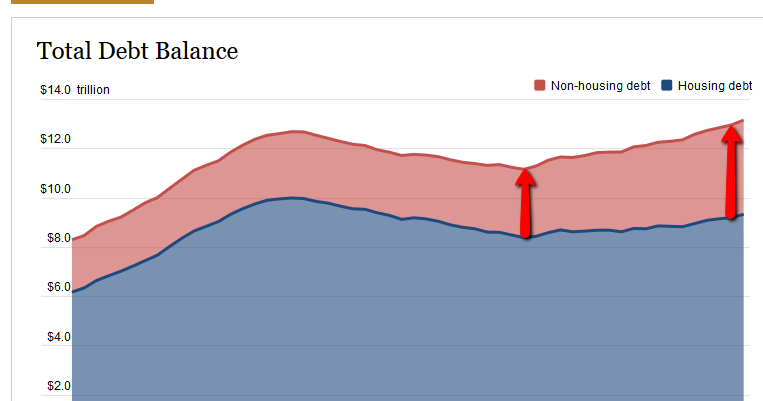

Just a couple of quick hits from the report. Total U.S. household debt rose $193 billion in the 4th quarter, to a new all-time peak of $13.15 trillion. That’s 17.9% above the most recent trough in Q2 2013. Broken down by segment, what do you suppose was the largest gain in percentage terms? Credit cards, with a 3.2% increase. In the picture above, the widening gap represented by the red arrows reflects the fact that non-housing debt is rising at a faster pace than housing debt.

Here’s what’s troubling about that. Below is a picture of the stock market, as represented by the S&P 500 index, over that same period; from the most recent credit trough in Q2 2013 to the end of 2017.

And thus, the title of this article. Over that period, the S&P 500 index rose by 75%; from roughly 1,600 to 2,800. Apparently, however, the riding tide did not lift all boats. One would think that, burned by the financial crisis of 2008-2009 and riding a wave of profits from the stock market, U.S. households would have been both eager and able to trim those debt levels. Perhaps some did, but clearly not all. And that is troubling, because it means the bulk of those gains have ended up in the hands of a few, while many continue to struggle.

But more than that, we’ve recently seen the first solid hints of inflation, and rising interest rates. In the main, it was this threat that led to last week’s violent action in the markets.

Lots of debt colliding with rising interest rates. It’s a challenge the U.S. government will face. But so, apparently, will many U.S. households.

[ad_2]

Image and article originally from etfmonkey.blogspot.com. Read the original article here.